Ambani Adani partnership | RIL selects a 26%share in the Adani power venture.

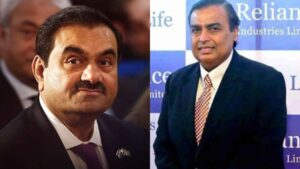

The two largest businessmen in the nation, Mukesh Ambani and Gautam Adani, have united in the power industry through an equity-for-captive power agreement, forming an unusual grand alliance just as they are getting ready to fight it out in the green energy arena. The main business of Ambani, Reliance Industries Ltd (RIL), has reached an agreement whereby it will acquire a 26% share in a Madhya Pradesh-based Adani Power subsidiary in return for 500 MW of captive power from a coal-based energy generating facility.As per the agreement, RIL will acquire a 26% stake in Mahaan Energen Ltd (MEL), an Adani Power Ltd (APL) wholly-owned subsidiary, for a sum of Rs 50 crore. The arrangement is due to the Electricity Rules, 2005, which state that a power plant cannot be considered a “captive generating plant” unless the captive user(s) has at least a 26% share in the unit. There is also a requirement that at least 51% of the power produced by the plant be used for captive purposes.

APL announced in a late-night regulatory filing on Wednesday that MEL and RIL had signed a 20-year long-term Power Purchase Agreement (PPA) for 500 MW under the terms of the 2005 Electricity Rules’ “Captive User” policy. It further stated that, of the 2800 MW total existing and future capacity of MEL’s Mahan thermal power plant, one unit with a 600 MW capacity will be identified as the captive unit for this purpose. “RIL must own a 26% ownership interest in the captive unit in proportion to the power plant’s overall capacity in order to benefit from this strategy. As a result, it will invest Rs 50 crore in 5 crore equity shares of MEL for proportionate ownership stake’’, APL added.

RIL stated in a different filing that it anticipates finishing its investment in two weeks following the fulfillment of prerequisite conditions and the receipt of relevant MEL approvals. Where Reliance Industries planned to use the massive amount of captive power from the MEL facility was not immediately apparent. The company already operates captive units at its Gujarati petrochemical and oil refining facilities.

Purchased plant MEL was incorporated on October 19, 2005, and is a power generation and supply company. The power plant, known as Essar Power MP Ltd. and formerly owned by the Ruia family, became insolvent. Through the Insolvency and Bankruptcy Code (IBC) resolution process, Adanis purchased it in March 2022. In Tehsil Mada, Singrauli district, Madhya Pradesh, the power plant in Singrauli runs a 1,200 MW (2×600 MW) thermal power plant (Phase-I project) in the villages of Bandhaura, Khairahi, Karsualal, and Nagwa. The factory is near well-known coal-producing areas.

In Phase-II, MEL plans to increase its generating capacity by constructing two 800 MW ultra supercritical units based on pulverized coal, for a total capacity of 1600 MW. Compared to Rs 1393.59 crore in the previous fiscal year, it reported a turnover of Rs 2730.68 crore for the year that ended on March 31, 2023.

Green power The two massive companies have revealed ambitious intentions in the field of green energy, which is predicted to become a new battlefield of competition in which the two titans will soon face off. By 2030, the Adani Group hopes to overtake Reliance as the leading generator of renewable energy globally. Reliance is as optimistic about constructing four gigafactories in Jamnagar, Gujarat, one for fuel cells, batteries, solar panels, and green hydrogen. In addition, the Adanis are constructing three gigafactories to produce hydrogen electrolysers, wind turbines, and solar modules. The MEL captive power agreement represents the two major conglomerates’ first direct transaction